Navigating the world of SASSA grants can sometimes seem daunting, especially with multiple grants available, each catering to the various needs of South African citizens. Whether you’re a beneficiary of the SRD R350 grant or you’re keen on understanding the nuances of child and old age grants, it’s pivotal to be informed. One of the most crucial elements for grant beneficiaries is the accurate submission of srd.sassa.gov.za banking details on the platform.

Don’t provide your bank details to any website other than the Official SASSA website, and be very careful when doing so.

Step by Step Guide: srd.sassa.gov.za Banking Details Update

The Social Relief of Distress (SRD) grant of R350 is contingent upon accurate banking detail submission. The following steps ensure a seamless process for the same:

Step 1: Logging into the SASSA Portal

- Visit the official SASSA SRD portal at srd.sassa.gov.za.

- Enter your South African ID number and your cell phone number. These details are used to verify your identity and grant access to your account.

Step 2: Navigating to the Banking Details Section

- Once logged in, look for the option that says “Change Banking Details” or something similar. This is usually found on the main dashboard or under a specific menu related to personal information.

- Click on this option to proceed to the banking details update section.

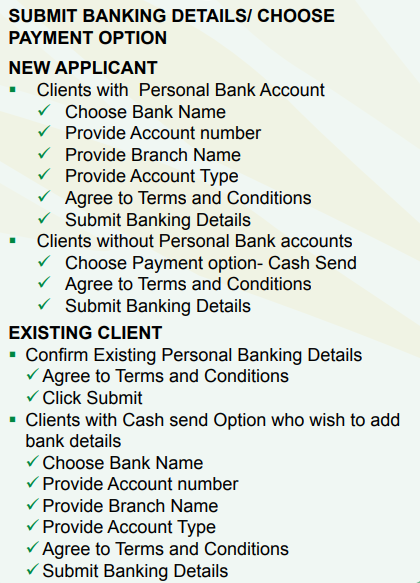

Step 3: Entering New Banking Details

- In the banking details section, you will be prompted to enter your new banking information. This typically includes:

- Bank Name

- Account Number

- Account Type (e.g., Savings, Cheque)

- Carefully enter your new banking details. Double-check the information to ensure accuracy, as any errors could lead to payment issues.

Step 4: Submitting the Changes

- After entering the new details, review the information once more.

- Click on the “Submit” button to save your changes.

- You might be asked to confirm your changes via an OTP (One-time PIN) sent to your registered phone number.

Step 5: Confirmation

- Once submitted, you should receive a confirmation message or email indicating that your banking details have been successfully updated.

- Keep an eye on your bank account to ensure that the next SRD payment is processed correctly into your new account.

Please Remember

- Only provide your bank details on the official SASSA website.

- Ensure that the bank account belongs to you. SASSA prohibits transferring grants to someone else’s bank account.

- If opting for a money transfer via major banks, the receiving cellphone number should be registered in your name. Payments won’t process if the number is registered under a different name.

- Ensure your banking details are accurate. Incorrect information will stall your SASSA status approval.

The cellphone number on which you received the SMS must be registered to your name if you choose the money transfer option via one of the major banks. Your grant will not be paid if the registered mobile phone number belongs to someone else. Payments will only be made with new banking details after verification has been completed. Your Sassa status check will not be approved if you do not have the correct SASSA update banking details on the site.

You may enjoy reading Sassa Grants Payment Dates

Important facts

- Payments with new banking details will only be processed after thorough verification.

- Avoid sharing your ID number and banking details outside the official SASSA platform to prevent scams.

What Not to Do

- Never share your SASSA login details or password with anyone.

- Refrain from using unofficial platforms to submit sensitive information.

Why Updating Your Sassa Banking Details is Important

Keeping your banking details current with SASSA ensures:

- Direct deposits, eliminate the need for paper checks.

- Minimized risks of payment discrepancies or delays.

- Swift access to funds without the unnecessary bureaucratic hold-ups.

The South African Social Security Agency (SASSA) offers multiple grants tailored to cater to the specific needs of various segments of the population. While the process of updating banking details across different grants might appear similar at first glance, each comes with its unique requirements and points of differentiation. In this guide, we’ll delve into the procedure for updating banking details for the SASSA R350 Grant, Child Grant, and Old Age Grant, outlining their specificities. Look at Buy Airtime with SASSA Card.

1. SASSA R350 Grant (SRD – Social Relief of Distress Grant)

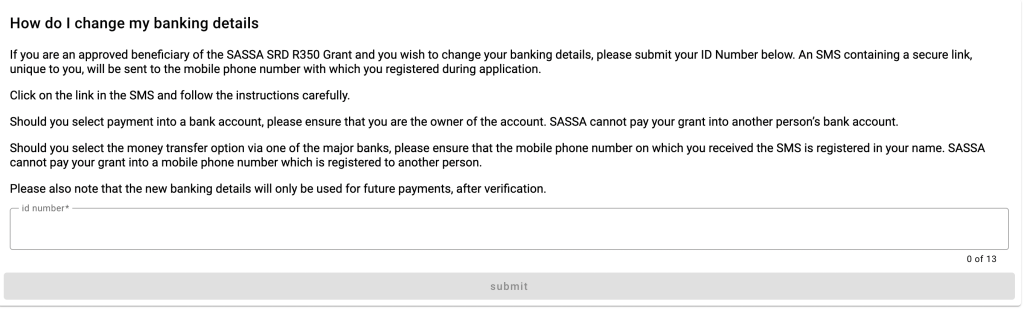

How To Change Banking Details For Sassa

- Go to the official SASSA SRD website: srd.sassa.gov.za.

- Navigate to the section labeled “How do I change my banking details”.

- Input your South African ID number.

- Upon validation, you’ll receive an SMS with a link.

- Access the link and follow the instructions to update your banking details.

Documents Required:

- A valid South African ID or Temporary ID document.

- Recent bank statement or a letter from your bank confirming account details.

Points of Difference: This grant is a temporary provision, often subject to the prevailing economic conditions or emergencies such as the COVID-19 pandemic. It’s typically aimed at individuals currently unemployed and not receiving any other form of SASSA grant.

2. SASSA Child Grant change Banking Details

Sassa Change Banking Details

- Visit your nearest SASSA local office or approved pay point.

- Fill in the required banking details change form provided by the office.

- Submit it along with the necessary supporting documents.

Documents Required:

- Valid South African ID or Temporary ID document of the guardian or parent.

- Birth certificate of the child.

- Recent bank statement or a letter from the bank confirming account details.

- Proof of guardianship or parental rights if the person updating is not the biological parent.

Points of Difference: This grant is focused on the welfare of children. It requires documentation that directly relates to the child and the caretaker’s relation to the child.

3. SASSA Old Age Grant change Banking Details

How to Update Banking Details SASSA

- Approach your nearest SASSA local office or approved pay point.

- Obtain the appropriate form to request a change in banking details.

- Complete the form and attach all requisite supporting documents.

Documents Required:

- Valid South African ID or Temporary ID document of the elderly individual.

- Recent bank statement or a letter from the bank confirming account details.

- Proof of current address or residency.

Points of Difference: Aimed at senior citizens of South Africa, this grant necessitates details specific to the elderly, ensuring they get financial support tailored to their needs.

Frequently Asked Questions

Can I submit my banking details in person at a SASSA office?

How long does it take for the changes to take effect?

What should I do if I encounter an error during the submission process?

Can I update my banking details at any time?

Is my personal information safe when submitted online?

I am Eddie Ross, for those who rely on the SASSA, I am passionate about providing useful resources. As well as providing step-by-step guides and the latest information related to SASSA.